Asset class recap for August

August was a good month for both stocks and bonds, continuing a multi-month strong price growth trend. In the table below, all of the high-level asset classes we track except Small Cap Stocks had a positive return in August. In the Year-to-Date column, we can see that all asset classes except Long Term Bonds are on track for an above average year.

The S&P 500 hit its all-time high closing price on 7/16/24 and has shown some choppiness since then, but remains near its high level. The first three business days of August had an eyebrow raising 6.1% drawdown in the S&P 500 index caused largely by a few disappointing macroeconomic readings and bad Intel earnings, but the market fully recovered within the next seven business days. This sort of heightened volatility is typical of stock markets when they cross new high levels. When prices appreciate sharply, it can take a while for earnings to catch up and for valuations to return to an equilibrium level.

Value stocks outperformed Growth stocks in July and August. Quarterly earnings and future revenue guidance from some companies that benefitted from the recent A.I. price run-up have not been quite as high as some investors were hoping and questions about just how profitable large investments in A.I. related projects might be have led some analysts to revisit their discounted cash flow models to make downward adjustments.

Small caps were our worst performing asset class in August, with price losses. Economic uncertainty impacts them more strongly than it impacts larger corporations – in particular, the looming threat of higher corporate tax rates, additional regulations, and less interest rate cuts for 2024 than expected at the start of the year have put pressure on Small Cap Stocks.

International Stocks are showing signs of life, as the MSCI EAFE index outperformed the S&P 500 index during July and August. The Euro strengthened versus the U.S. Dollar in July and August, with the Euro costing $1.071 at 6/30/24, but costing $1.108 at 8/31/24, for a drop of 3.5% in the Dollar’s purchasing power so far this quarter. This currency shift adds return to the MSCI EAFE for U.S. investors who are not employing a hedging strategy (which we feel is an unnecessary expense for long term diversified investors). As the U.S. Fed gets closer to cutting interest rates, the Dollar gets less attractive because bond investors may earn higher yield on bonds denominated in alternative currencies.

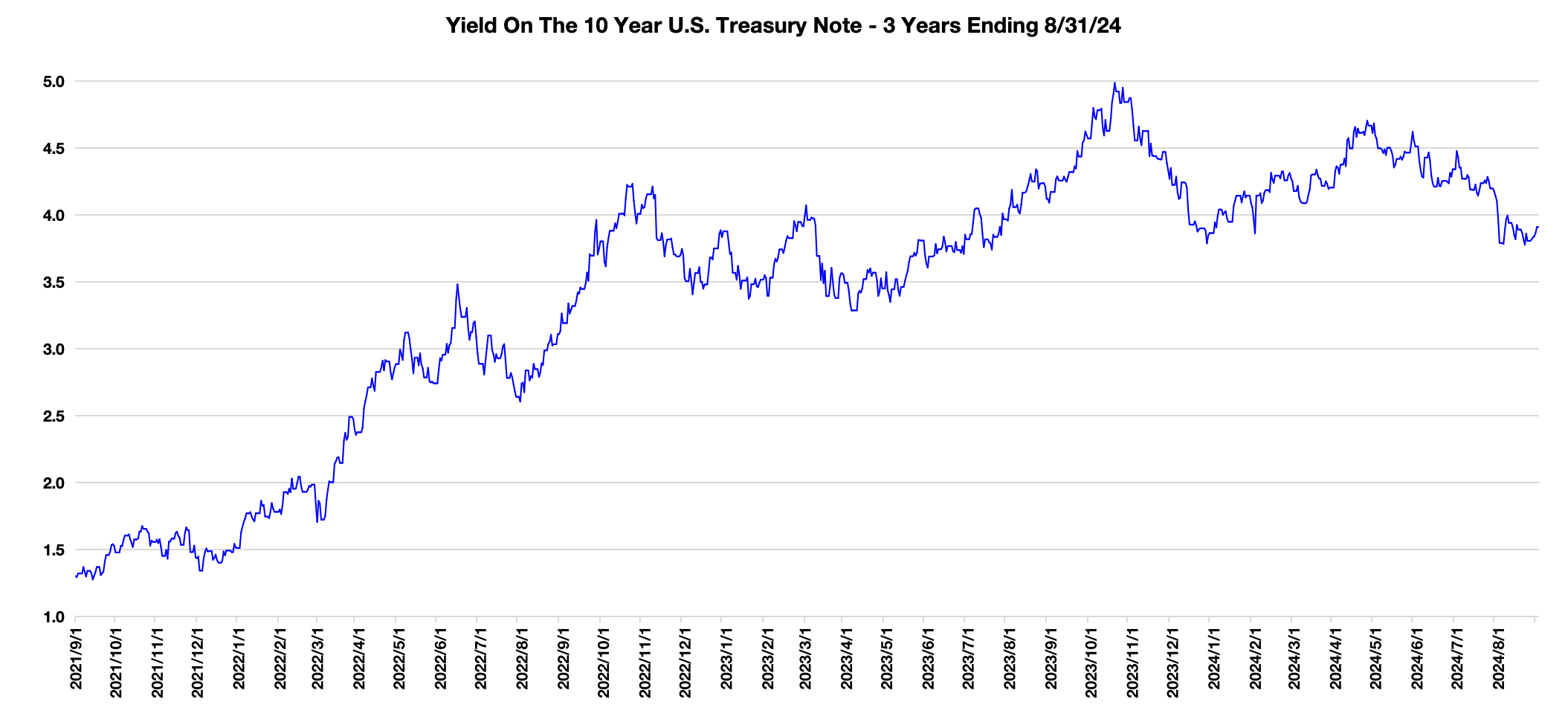

Bonds have enjoyed a solid run since 5/1/24, as the yield on the 10 Year Treasury Bond has been steadily dropping. 10 Year Treasury Bond yields dropped 0.17% in May, 0.17% in June, 0.23% in July, and 0.20% in August. Many investors have been exiting shorter term debt and CDs in favor of longer-term debt, to lock in rates at today’s levels for an extended time period in anticipation of U.S. Fed short term rate cuts. While recent bond returns look good from a short, one-year time frame, they still have a long way to go to fully recover from their 8/2020 to 10/2022 rising rate cycle induced drawdown.

Looking Forward

We have a solid Value overweight in the majority of our portfolios (we don’t implement Growth / Value tilting in portfolios with very low equity levels) that has been working out well. As Value stocks have outperformed Growth stocks in July and August, the gap between valuations for Growth and Value has started to shrink, but is still at historically wide levels. We will hold onto our Value overweight until we see the valuation gap shrink much further.

During mid-July, we made a slight shift away from international stocks and into large cap and small cap U.S. stocks. This shift has worked against us, but our rationale for the shift has not changed, so we are staying with this tilt. There has been a lot of discussion among politicians about adding tariffs, taxes, or other financial and non-financial burdens to non-U.S. corporations. If these changes come to pass, we expect these changes to be detrimental to non-U.S. stock returns.

Among bonds, we are continuing to maintain our duration underweight. The yield curve is starting to steepen, making longer term bond yields more attractive, but we feel that long bonds are not yet worth the duration risk that comes with owning them. When the Fed starts to lower their overnight lending rate, we expect our short-term bonds to appreciate in price as their fixed coupons are more attractive than lower yielding new issues with similar maturity dates.

Important Disclosures

Opinions expressed are as of the current date; such opinions are subject to change without notice. Advyzon Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment or a recommendation for a particular product.

Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. This commentary contains certain forward-looking statements. We may use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

Investment management and financial advice offered by Advyzon Investment Management is intended for citizens or legal residents of the United States or its territories. Investing in securities involves risks, including but are not limited to; currency risk, political risk, geographic risk, concentration risk, custody risk, asset class risk, management risk, market risk, operational risk, passive investment risk, securities lending risk, tracking error risk, tax risk, valuation risk, and infectious illness risk. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. High yield debt (non-investment grade or junk bonds) can be riskier than higher rated debt, typically has a higher default rate than investment grade and treasury debt, and high yield funds can lose principal.

“SBBI” stands for “Stocks, Bonds. Bills, and Inflation”. “Stocks, Bonds, Bills, and Inflation”, “SBBI”, and “Ibbotson” (when used in conjunction with a series or publication name) are registered trademarks of Morningstar, Inc. ©2021 Morningstar. “CRSP” stands for Center for Research in Security Prices. Part of the University of Chicago’s Booth School of Business, the CRSP is a nonprofit organization that is used by academic, commercial, and government agencies to access information such as price, dividends, and rates of returns on stocks.

The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Advyzon Investment Management cannot guarantee its accuracy, completeness or reliability.

Advyzon Investment Management LLC (“AIM”) is a registered investment adviser registered with the United States Securities and Exchange Commission, and a wholly-owned subsidiary of yHLsoft Inc., doing business as Advyzon (“Advyzon”). Registration does not imply any level of skill or training. AIM’s advisory services are available to financial advisers for use in managing assets for their clients. We do not provide advisory services directly to retail investors.