Asset class recap for February

Stocks had a very good February and returns are now in strongly positive territory across the board for 2024 year-to-date. Bonds have not done as well and posted a second consecutive month of poor returns, as investors are realizing that the U.S. Fed is unlikely to lower interest rates as much as investors expected at the end of 2023.

Investors liked what they saw from corporate earnings reports in February and bid prices up to new record highs. The market became almost effervescent after NVIDIA’s earnings report on February 21 beat expectations. A significant part of the stock market’s price appreciation since Oct 2022 has been due to expected growth in revenues and profitability due to Artificial Intelligence advancements. NVIDIA’s 769% year-over-year net income growth provided evidence that some of the hype may be warranted.

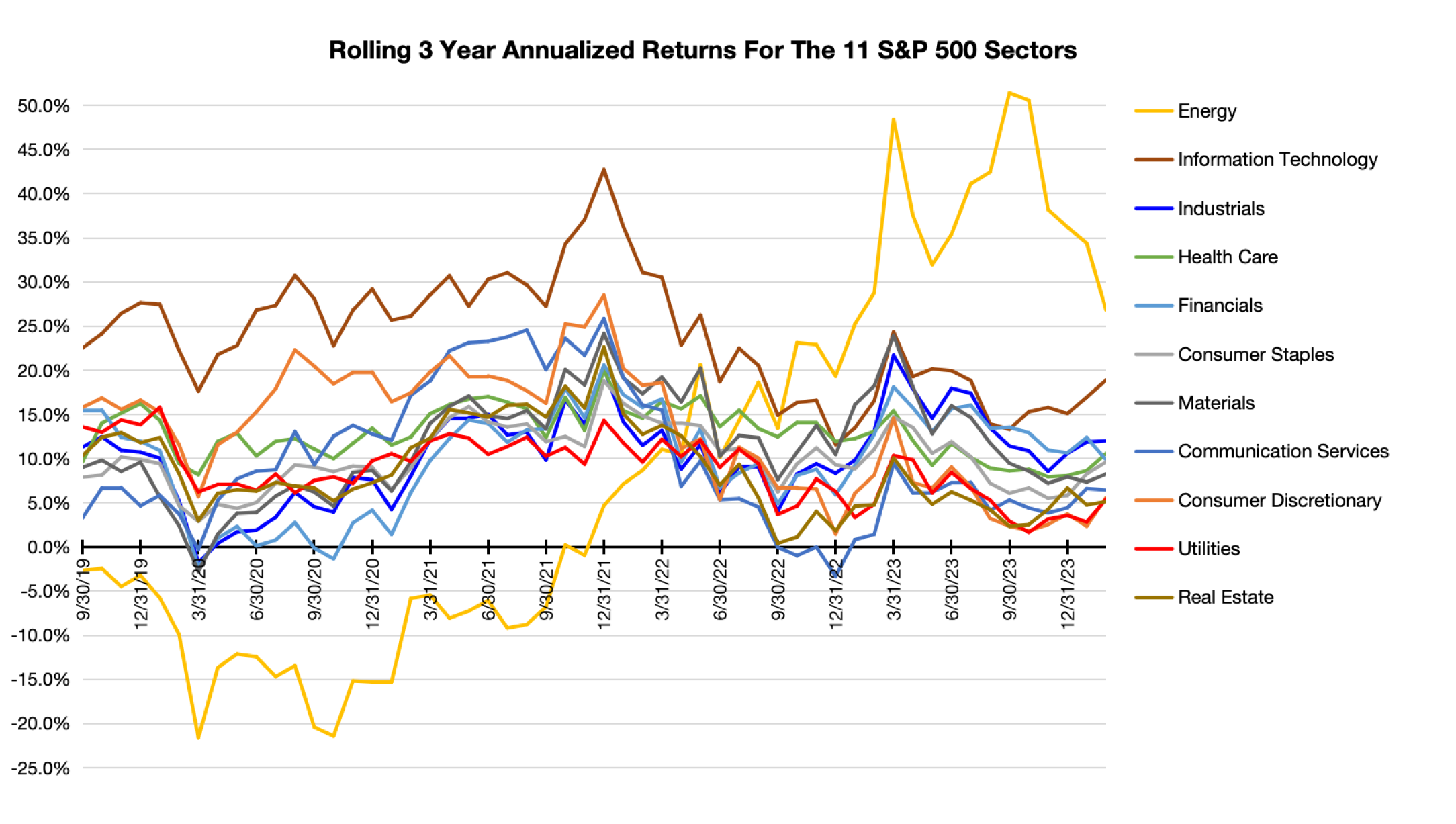

Technology stocks are up an annualized 18.9% over the last 3 years, but many investors do not realize that Tech stocks are not the market leading sector over this period. Energy stocks are up even more, with an annualized return of 26.9%. The import ban on Russian petroleum that resulted from the invasion of Ukraine pushed up oil prices significantly and created strong demand for U.S. oil. The chart below shows rolling 3 year annualized returns for each of the 11 U.S. stock market sectors. The yellow line shows that Energy stocks exhibit a low correlation with other stock sectors.

Banks and Commercial Real Estate Risk

During our Advyzon Conference two weeks ago, a few advisors brought up the topic of potential riskiness in the banking sector due to Commercial Real Estate exposure. Commercial Real Estate faces the double-whammy of a sharp rise in interest rates over the last couple years and a decline in demand for office space because many people are working from home after COVID. Many builders financed commercial construction at low interest rates between 2009 and 2021. Now that interest rates are back up to normal long-term levels, many builders are going to have to refinance their buildings at meaningfully higher interest rates. This potential problem is not just an issue for real estate related borrowers, but any other borrower who has a high debt to income ratio and may have difficulty continuing to make a profit by passing higher interest costs on to clients.

A major macroeconomic factor that is providing an offsetting tailwind for banks is the recent steepening of the yield curve. Most banks borrow at shorter term rates and lend at longer term rates. When the yield curve is inverted (short term rates are higher than long term rates), banks have a harder time generating profits through traditional banking. When the yield curve is upward sloping (long rates are higher than short rates), banks earn a wider spread on traditional lending. A second macroeconomic factor that has benefitted banks and will likely continue to benefit banks during 2024 is strong U.S. GDP growth. When the economy overall does well, banks tend to have lower loan default rates. Although we expect to see challenges for some Commercial Real Estate loans, most other borrowers are doing well. Investment grade credit spreads have been dropping since October 2022, providing evidence that most borrowers are not having trouble covering their financing costs.

There are over 4,000 banks in the U.S. and they can have very unique specializations when it comes to lending. I expect that there will be a few banks that run into difficulty because their loan portfolios are overweight on shorter term, lower credit quality, Commercial Real Estate lending. However, this does not feel like a 2007 / 2008 scenario when lending standards for a majority of lenders were obviously too loose and many sub-prime borrowers who were at high risk of having difficulty repaying loans were approved for loans. Overall, I expect the tailwinds mentioned above to more than offset Commercial Real Estate related loan losses. I continue to predict that 2024 will be bright for the financial sector relative to the market overall.

Disclosures

Opinions expressed are as of the current date; such opinions are subject to change without notice. Advyzon Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment or a recommendation for a particular product.

Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. This commentary contains certain forward-looking statements. We may use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

Investment management and financial advice offered by Advyzon Investment Management is intended for citizens or legal residents of the United States or its territories. Investing in securities involves risks, including but are not limited to; currency risk, political risk, geographic risk, concentration risk, custody risk, asset class risk, management risk, market risk, operational risk, passive investment risk, securities lending risk, tracking error risk, tax risk, valuation risk, and infectious illness risk. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. High yield debt (non-investment grade or junk bonds) can be more risky than higher rated debt, typically has a higher default rate than investment grade and treasury debt, and high yield funds can lose principal.

“SBBI” stands for “Stocks, Bonds. Bills, and Inflation”. “Stocks, Bonds, Bills, and Inflation”, “SBBI”, and “Ibbotson” (when used in conjunction with a series or publication name) are registered trademarks of Morningstar, Inc. ©2021 Morningstar.“CRSP” stands for Center for Research in Security Prices. Part of the University of Chicago’s Booth School of Business, the CRSP is a nonprofit organization that is used by academic, commercial, and government agencies to access information such as price, dividends, and rates of returns on stocks.

The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Advyzon Investment Management cannot guarantee its accuracy, completeness or reliability.