Asset Class Recap for the Quarter

Stock returns produced a third consecutive quarter of positive, above average returns for all broad asset classes that we track below. Encouraging earnings report and fervor over stocks related to artificial intelligence (A.I.) fueled optimism for equities. Bonds saw prices drop across most asset classes, as longer-term interest rates slowly marched upward. Only High Yield bonds were able to break the pattern to post a positive return, as waning concerns about a recession pushed prices for High Yield Bonds up more than rising interest rates pulled their prices down.

As we look down the Year-To-Date column, we can see that every asset class has experienced a rebound in 2023, but not quite enough to recoup 2023’s losses yet (ignoring Cash). US Growth Stocks look like they are very close to covering last year’s losses, with a +29.0% return for 2023 so far, vs a -29.1% loss for 2022. However, the way percentages work can be misleading… An investor needs to have a +41.1% return to offset a -29.1% loss, so investors may need to be prepared to wait a few more quarters before account values get back up to high water marks - - the Fed’s rate rising campaign cut deep!

Bond prices dropped for most bond types in Q2 as interest rates rose. The yield on a 10 Year Treasury Bond rose from 3.49% at 3/31/23 to 3.82% at 6/30/23. For bonds with a 6 duration (a typical duration for the type of Intermediate Bonds that dominate many investors’ portfolios), that results in an estimated 1.98% price drop (= -1*(3.82%-3.49%)*6). That foots with a -0.84% total return for the Bloomberg US Agg Bond index, if we assume that we also received coupon payments for 1.14% (total return of -0.84% = price return of -1.98% + yield return of +1.14%). After the record-breaking negative returns that investors suffered through in fixed income in 2022, these additional losses will Not be welcome when conservative investors review their quarterly statements.

High Yield was the only fixed income asset class with a positive return last quarter. High Yield credit spreads were at elevated levels during March, as the regional banking crisis and recession concerns created anxiety about potential defaults for some High Yield Bonds. Credit spreads are a measure of how much extra yield investors are being paid to accept higher risk in some bonds versus guaranteed treasury bonds with a similar maturity date. High Yield credit spreads peaked at 5.20% on 3/15/23 and then dropped down to 4.05% by 6/30/23. The median High Yield credit spread since 1/1/1996 has been 4.76%, indicating that bond investors expect that markets may be safer than average in today’s environment – a positive signal for the economy, however, a bit less exciting if you are buying High Yield Bonds today and you must accept a credit spread that is below average. If High Yield Bond prices increase and credit spreads drop much further, we will reduce our High Yield Bond exposure in our Advyzon portfolios.

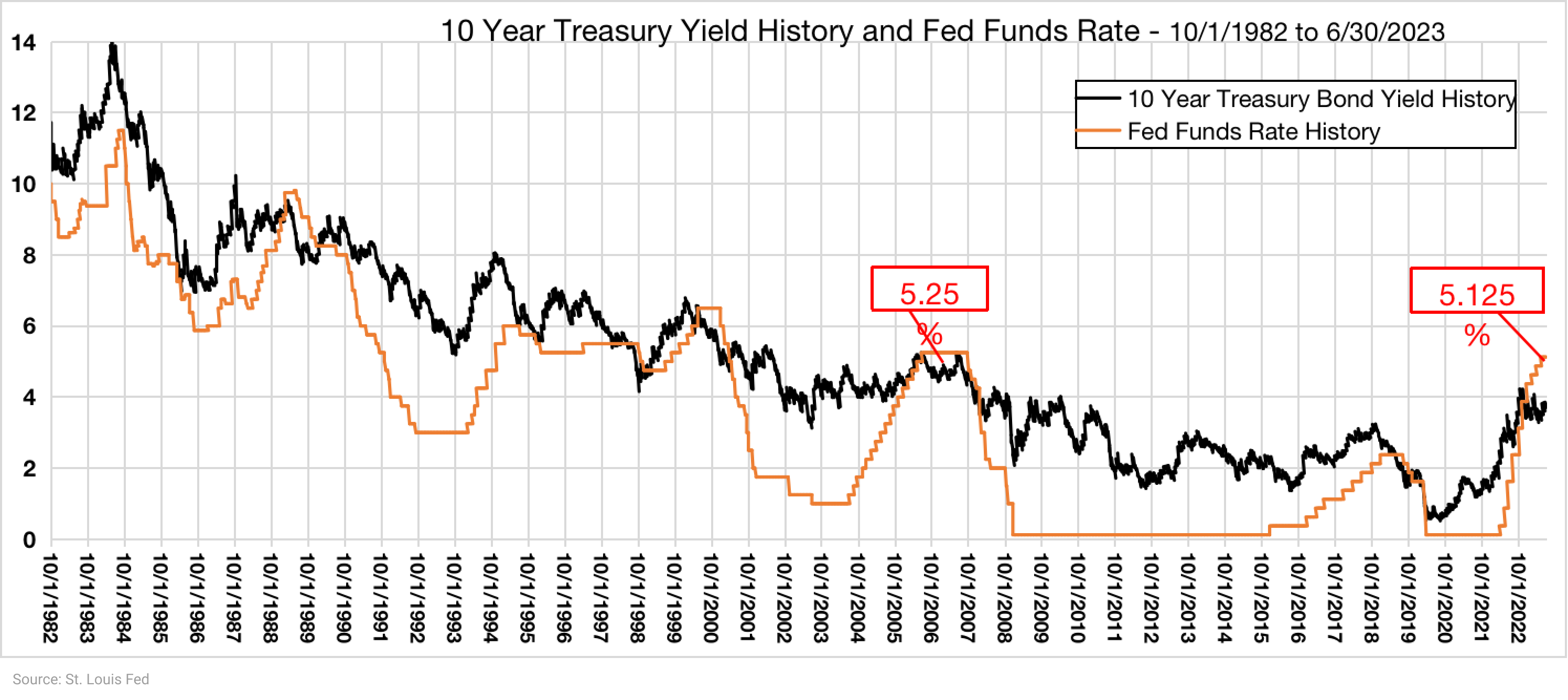

The US Fed meets 8 times per year to discuss the economy and to agree on a target level for the Fed Funds Rate. To combat high inflation, the Fed started raising interest rates in March 2022. They raised rates at 10 consecutive meetings. But at the 6/14/23 meeting, they elected to not raise rates. This was terrific news for stocks, because interest rates are an important input into many investors’ valuation models.

There has been a lot of conversation among economists about whether the Fed’s actions at their remaining four 2023 meetings will be to raise rates, stay put, or lower rates. The Fed has a “dual mandate” to keep employment at healthy levels and to keep inflation at reasonably low levels. They are “data dependent” and monitor many variables to make their decisions. With employment at very acceptable levels and with inflation clearly dropping back toward the Fed’s 2% target, we expect the Fed to hold rates where they are at for the foreseeable future – until the next, unpredictable, inevitable macroeconomic event pops up. At the current target rate of 5.125%, we are at roughly the level where they stopped raising rates last time things were “normal”, in 2006 and 2007 (the red boxes below).

Growth stocks have produced terrific returns Year-To-Date in 2023. The Russell 1000 Growth index is up a whopping 29.0%, while Value stocks are up a pedestrian 5.1%. Anyone who follows the financial press has been inundated with news about advances in Artificial Intelligence and experts who predict that A.I. will revolutionize the workplace and world. Rising stock prices for companies related to A.I. have been the major driving factor behind Growth’s strong recent performance run. Exciting advances in this field will certainly lead to additional profits for corporations that are able to bring true advances to consumers or expense savings to businesses - but we should always watch out for bubbles that can result in permanent loss of principal for late market entrants.

To examine valuations for excess frothiness, we pulled up Year-To-Date returns for all 500 stocks in the S&P 500 index. 19 of those stocks are up more than 50% this year. We also retrieved earnings for those firms and calculated Trailing Twelve Month Price-to-Earnings ratios.

Not all of the 19 stocks with 50%+ returns are officially categorized as Technology sector stocks, but most are in the Tech sector, or clearly lean that way. The current P/E for the overall S&P 500 index is roughly 26 today. The P/E column on the right above, identifies stocks with P/Es above average in red. Some of these stocks are very far above normal valuation levels. Certainly, most Growth stocks deserve to have P/E values that are above average, as their growth prospects are bright, but NVIDIA’s 216 would require that this mature company quadruple their earnings to come back down to a more reasonable 54 P/E! These valuation levels for these Growth stocks lead us to feel that Growth may be overvalued and that A.I. hype may be a little overdone. Our Advyzon portfolios are slightly overweight to Value and we are maintaining that overweight.

Disclosures

Opinions expressed are as of the current date; such opinions are subject to change without notice. Advyzon Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment or a recommendation for a particular product.

Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. This commentary contains certain forward-looking statements. We may use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

Investment management and financial advice offered by Advyzon Investment Management is intended for citizens or legal residents of the United States or its territories. Investing in securities involves risks, including but are not limited to; currency risk, political risk, geographic risk, concentration risk, custody risk, asset class risk, management risk, market risk, operational risk, passive investment risk, securities lending risk, tracking error risk, tax risk, valuation risk, and infectious illness risk. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. High yield debt (non-investment grade or junk bonds) can be more risky than higher rated debt, typically has a higher default rate than investment grade and treasury debt, and high yield funds can lose principal.

“SBBI” stands for “Stocks, Bonds. Bills, and Inflation”. “Stocks, Bonds, Bills, and Inflation”, “SBBI”, and “Ibbotson” (when used in conjunction with a series or publication name) are registered trademarks of Morningstar, Inc. ©2021 Morningstar.

“CRSP” stands for Center for Research in Security Prices. Part of the University of Chicago’s Booth School of Business, the CRSP is a nonprofit organization that is used by academic, commercial, and government agencies to access information such as price, dividends, and rates of returns on stocks.

The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Advyzon Investment Management cannot guarantee its accuracy, completeness or reliability.

Cryptocurrencies, including Bitcoin, are currently unregulated, illiquid, uninsured, carry technological risks, require unique tax treatment, and are volatile.