Asset Class Recap for the Quarter

Stock and bond returns are doing quite well so far this year, as shown in the First Quarter 2023 column below. At this high asset class grouping level, all asset classes have positive returns, providing a partial rebound from last year’s losses. Investors who stayed in the market after last year’s significant pullback are being rewarded.

The most important events that are driving market returns so far this year have been evolving expectations for the Fed’s next short term interest rate move, the recent decline in 10 year treasury bond yields, and the failure of two regional banks. The Federal Reserve System’s US Federal Open Market Committee (FOMC) meets 8 times per year to decide what to do with the short term interest rates they control. The Fed has raised rates at their last 9 meetings to combat high inflation that originally flared up in March 2021.

The Fed’s next meeting is on May 2. The Fed has a dual mandate of maximizing employment and keeping inflation in check. Inflation has been coming down slowly since its peak in July of last year, but the most recent annualized reading of 6.1% is still above the Fed’s target of 2%. For that reason, I expect the Fed to raise rates again at its May meeting. Some macroeconomic indicators are slowing down and suggest that unemployment may rise and the economy may have a recession soon, which has prompted some economists to suggest that the Fed should not raise rates further, but those concerns are less certain and farther down the road than the very present inflation problem.

The place where see some real differentiation in returns for the last 15 months is when we slice the US stock market into sectors. Sectors that performed exceptionally poorly last year (gray in the 2022 column below) are doing exceptionally well Year-to-Date (green in the YTD column below) and vis-a-versa. This type of see-saw action among sectors is typical when we look at short periods like one year or one quarter and when we go through regime shifts, like going from rising rates to falling rates (see the yield discussion below). But when we zoom out to a longer term 10 year or 20 year view (the right columns below), things smooth out and investments in all sectors have paid off. Our Advyzon portfolios are diversified across all 11 of these sectors.

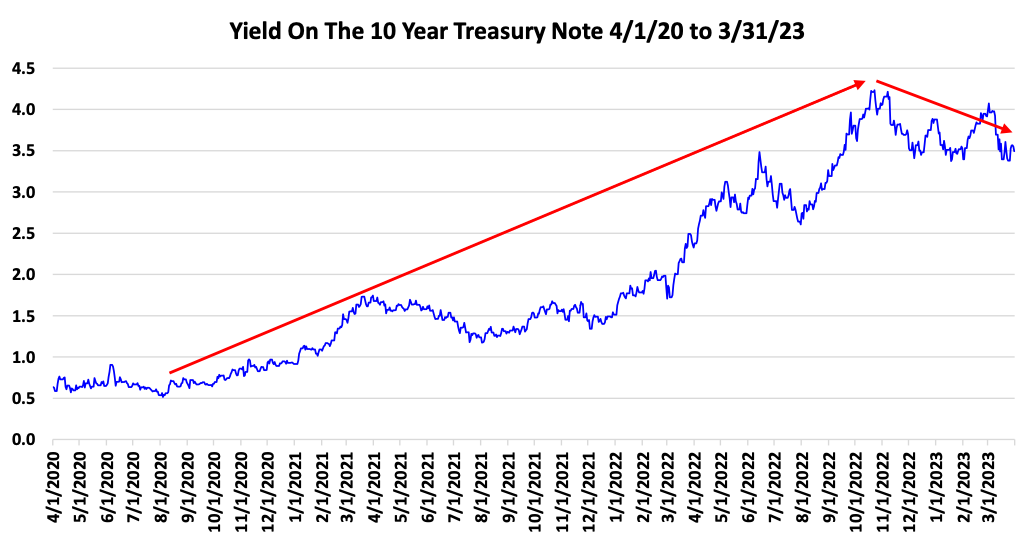

A chart of recent history for 10 Year Treasury Note yields shows that we had an inflection point on 10/23/2022, when the yield hit a recent high of 4.23%. Since that point, yields have slid, dropping to 3.49% at 3/31/2023. This has helped push prices up for both stocks and bonds year-to-date. As earnings for the end of 3rd quarter started coming out lighter than expected and regional banks disclosed issues, investors started to expect that the Fed might elect to stop raising rates soon. This is one of the unusual periods when bad news can be good news for stock prices - because slightly depressed earnings are less hurtful to stock prices than dropping interest rates are good for prices.

Among bonds, riskier bonds have outperformed safer bonds this year. This is typical for bond markets during a period when interest rates drop. Longer term bonds with fixed coupons benefit more from the duration effect (one approximate formula to calculate bond price changes is Δ Price = - Duration x (Δ Yield / 1 + Yield)). Lower interest rates improve interest rate coverage ratios for all corporations with debt, but especially help riskier companies that often have a questionable ability to cover their debt burden.

Market Expectations and Portfolio Positioning

When constructing portfolios at Advyzon Investment Management, we always focus on 1) being long term oriented, 2) using low cost investment products, and 3) being diversified to mitigate downside risks. However, we do watch markets closely, have expectations for one year periods, and include mild asset class tilts in our portfolios.

Factors that are likely to be positive for security prices over the next year -

- Interest rates have dropped recently, which reduces interest expense for corporations in upcoming quarters and should have a positive impact on earnings.

- Oil prices spent a lot of last year above $100 / barrel, but spent some time below $70 / barrel toward the end of March. Although this is detrimental for energy sector returns, lower energy prices reduce expenses for corporations and consumers and have a net positive impact on overall US stock and bond returns.

- China is reopening after their COVID flareup, which is likely to contribute to higher sales for corporations that sell products there.

Factors that are likely to be negative for security prices over the next year -

- The US National Debt and the associated annual interest rate payments are higher than they have ever been. The federal government has to reduce spending or increase taxes to deal with the ever-increasing budget deficit, as interest payments on our debt are growing as a percent of the overall annual federal budget. A debt limit faceoff is becoming increasingly more likely. Lower spending and/or higher taxes will have a negative impact on corporate earnings and security prices. (Visit www.usdebtclock.org for current statistics)

- There may be additional regional banks that disclose balance sheet issues, where they are carrying previously undisclosed bond losses on their books. Accounting rules allow banks to not disclose market losses on bonds that they categorize as Held-To-Maturity, but these “paper losses” become important when depositors take their money out of these banks and the banks are forced to sell the bonds at steep discounts (when the bonds are not held to maturity).

Issues that are very uncertain and could be good or bad for markets, depending on what the next year holds –

- Inflation has been coming down quickly, but is still a major concern. Inflation can be sticky and could even flare up again through a wage - price spiral. If that happens, the Fed could be forced to increase rates at least one more percent during 2023. This is unlikely but is a possibility. For perspective for younger people who did not follow markets 40 years ago - inflation reached 12.3% in the 1970’s and the Fed’s target interest rate was in the double digits until 1982.

- The yield curve is still inverted, where short term interest rates are higher than longer term rates. This situation never holds for very long. History teaches us that either short term rates drop, which would be good for markets, or longer term rates rise, which would be bad for markets. Currently elevated stock market valuations show that optimistic equity investors may be expecting shorter term rates to drop, however, the Fed has not yet announced any plans to decrease rates. Historically, the Fed has “won” this sort of disagreement more often than not.

We started the year expecting stock markets to return 5% to 15% for 2023. We are sticking with that forecast. With the S&P 500 index up 7.5% already this year, we are not expecting markets to increase much more, however, we are not concerned that equity markets are overheated. We are maintaining our value stock overweight, as energy and financial stock prices have come down during 2023.

We started the year concerned that bonds could have a below average year in 2023. The Bloomberg US Aggregate Index is up 3.0% this year with longer term bonds up more than shorter term bonds. We are worried that longer term bonds could be the most likely victim of yield curve flattening and longer term bond prices could drop by the end of the year. Our portfolios are currently underweight to longer term bonds and we are maintaining that positioning.

Disclosures

Opinions expressed are as of the current date; such opinions are subject to change without notice. Advyzon Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment or a recommendation for a particular product.

Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. This commentary contains certain forward-looking statements. We may use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

Investment management and financial advice offered by Advyzon Investment Management is intended for citizens or legal residents of the United States or its territories. Investing in securities involves risks, including but are not limited to; currency risk, political risk, geographic risk, concentration risk, custody risk, asset class risk, management risk, market risk, operational risk, passive investment risk, securities lending risk, tracking error risk, tax risk, valuation risk, and infectious illness risk. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. High yield debt (non-investment grade or junk bonds) can be more risky than higher rated debt, typically has a higher default rate than investment grade and treasury debt, and high yield funds can lose principal.

“SBBI” stands for “Stocks, Bonds. Bills, and Inflation”. “Stocks, Bonds, Bills, and Inflation”, “SBBI”, and “Ibbotson” (when used in conjunction with a series or publication name) are registered trademarks of Morningstar, Inc. ©2021 Morningstar.

“CRSP” stands for Center for Research in Security Prices. Part of the University of Chicago’s Booth School of Business, the CRSP is a nonprofit organization that is used by academic, commercial, and government agencies to access information such as price, dividends, and rates of returns on stocks.

The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Advyzon Investment Management cannot guarantee its accuracy, completeness or reliability.

Cryptocurrencies, including Bitcoin, are currently unregulated, illiquid, uninsured, carry technological risks, require unique tax treatment, and are volatile.