Asset Class Recap for the Quarter and Year

The fourth quarter provided a welcome bounce in prices for nearly all asset classes, following three consecutive quarters of large price declines for securities. Changes in prevailing interest rates and changes to expected future interest rates continued to be the primary driver of price changes in Q4.

Large Cap US stocks returned 7.6% in Q4, as measured by the S&P 500. This left the year’s total return at -18.1%. A “bear market” is typically defined as a period with a loss of 20% or more. US stocks had surpassed that level for 2022 at the last quarter end (at 9/30/22, the S&P was down 23.9% year-to-date) but signs that inflation may be abating gave investors hope that the US Federal Reserve may stop increasing interest rates sooner than previously expected, which gave a boost to stock prices and helped avert a calendar year bear market.

Value stocks outperformed Growth stocks during Q4 and during the full year. Energy stocks (traditionally a value sector) were the highest performing stock sector during Q4, during 2022, and 2021, as sanctions against Russian oil have kept global supply tight and pushed prevailing oil prices much higher than 2020 (remember when oil prices were negative for a day, on 4/20/2020?) Over the last 20 years, the Energy sector has exhibited the highest standard deviation among all stock sectors and is very hard to forecast, as exogenous nontraditional market factors can have swift, totally unexpected, and highly impactful effects on the price of oil and on earnings for energy companies. Communications Services was the worst performing sector for 2022, returning -39.9%, largely because these companies tend to have high debt loads and higher interest rates can cut deeply into profitability for these companies.

Bonds experienced a welcome positive price bounce in Q4. The Bloomberg US Aggregate Bond index was up 1.9% between 10/1/22 and 12/31/22. However, that did not do much to erase the damage inflicted by rising interest rates during the first three quarters of the year, as Bonds ended the year with a record smashing annual total return loss of 13.0%, made up of a +2.5% interest payment yield return and -15.5% price return. Previously (since 1947), the worst calendar year total return loss for the Aggregate Bond index was -2.9%, in 1994. The two primary factors that came together to push interest rates higher during 2022 were:

- Inflation rose, primarily driven by spiking commodity prices, resulting from the Russian invasion of Ukraine. Inflation may also be running hot due to unfettered fiscal spending by the US federal government.

- Interest rates were being held at historically low levels by the US Fed in 2020 and 2021 in response to COVID. Rates needed to start returning toward a free market normal level, as COVID was abating.

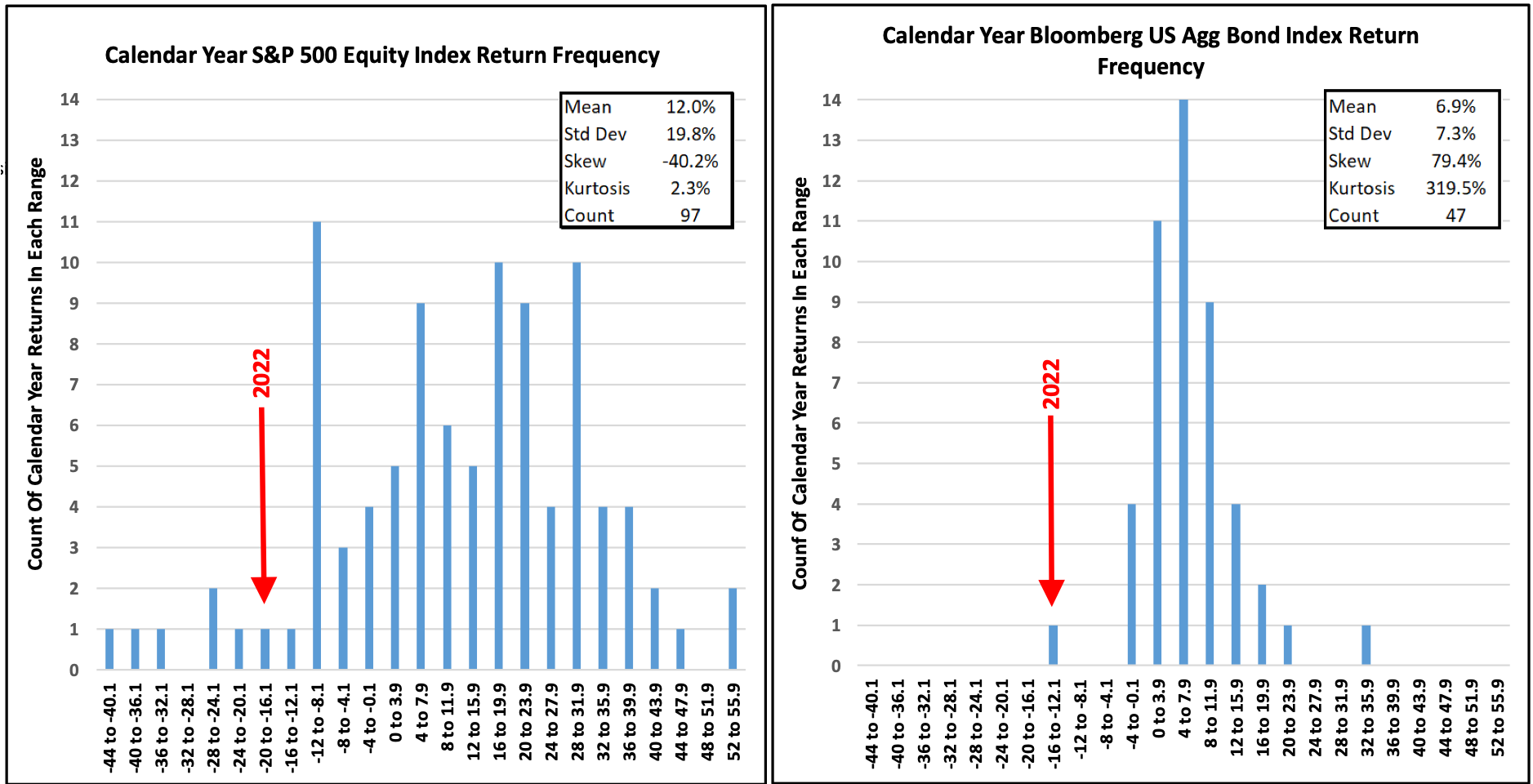

It is helpful to keep returns for 2022 in historical perspective. As the two histograms below depict, compared to historical experience, returns for stocks were bad, but returns for bonds were worse than any historical calendar year by far. The chart on the left is a histogram for annual equity returns between 1926 and 2022. 2022’s return of −18.1% for the S&P 500 Equity Index was the 7^th^ worst for these 97 years. The chart on the right is a histogram for annual bond returns between 1976 and 2022, measured by the Bloomberg US Aggregate Bond Index. The annual return of -13.0% is the worst for any of these 47 years by a whopping 10%. 1994’s return of -2.9% was previously the worst year for bond returns on record. The -18.1% for stocks can be forgiven by longer term investors, because it followed three terrific positive return years for stocks; 31.5% in 2019, 18.4% in 2020, and 28.7% in 2021. On the other hand, the -13.0% return for bonds followed a negative year of -1.5% in 2021, adding to the remarkability of 2022’s bond price drawdown.

Inflation has continued to be a major concern for consumers, workers, investors, and the US Federal Reserve. Thankfully, the most recent readings for inflation have tapered off significantly. Many pundits quote the Year-over-Year percent change for inflation, which is very important (the right column in the table below). But to get the best view of where inflation is headed right now, monthly values give a much more clear picture. The red percentage changes in the third column below show that monthly inflation levels have tapered off significantly since July. For this reason, we expect the Fed to stop raising the Fed Funds Target Rate sooner rather than later. This could lead other interest rates, like the 10 year T-Note yield, to also remain subdued.

We often use the asset class “quilt chart” below to help illustrate the impact of volatility among asset classes and to show the benefits of using a diversified portfolio like the ones Advyzon Investment Management constructs for investors. As you move from left to right, from year to year, and follow the dark blue Diversified 60% Equity / 40% Bond portfolio, you can see that it never climbs into the top 2 or into the bottom 3 rows in any year. Over the last 13 years (shown in the farthest right column), we see that a Diversified portfolio performed quite well.

Market Expectations and Portfolio Positioning

When constructing portfolios at Advyzon Investment Management, we always focus on 1) being long term oriented, 2) using low cost investment products, and 3) being diversified to take advantage of the lower risk benefits. However, we do watch markets closely, have expectations for 1 year periods, and include mild asset class tilts in our portfolios. Our expectations for 2023 are below:

Stocks are likely to have a typical return year in 2023, falling into the 5 to 15% range. 2022’s eighteen percent stock market price drop improved Price-to-Earnings ratios significantly, so we are starting 2023 at a much more attractive place than we started 2022. Although inflation has put pressure on corporate profits as expenses have climbed sharply, most corporations have reported that they have been able to increase prices and cut back on staff and other expenses to keep earnings-per-share growing.

During COVID, particular corporations and market segments benefited from heightened demand for their products. Many of these firms are producers of goods or services related to healthcare and products people needed more of when they started working from home instead of an office. Demand for these products is said to have been “pulled forward”. As COVID’s affects have waned, we have needed less of these products. These corporations enjoyed outsized revenue growth, profits, and stock price growth in 2020 and 2021. Subsequently, many suffered from sharply lower revenues, profits, and stock prices in 2022 as demand went back to normal or even lower than normal as consumers had plenty of these medical or work-from-home related items. Peloton is a great example, as its price per share was $25 at 3/2000 (at the start of COVID), grew to $150 at 1/2021 (as their products hit the height of demand), but fell to $10 by 1/2023 as orders have dropped massively. There may still be some stocks that have not yet felt the full brunt of the unwinding of the COVID demand pull forward. We will realize which companies these are as they calculate and release the next couple quarterly earnings reports and surprise investors with unexpected profit declines. Some of these may be healthcare related firms. The healthcare sector outperformed the S&P 500 by 16% in 2022 and we expect it may be due for a relatively poor year.

International stocks are likely to outperform US stocks in 2023. Valuations for international stocks have been more attractive than US stocks for many years, but that has not helped international stocks outperform, as the S&P 500 US stock index has outperformed the MSCI EAFE international stock index for 11 of the last 15 years. What is different today is our expectations for non-US currencies to appreciate versus the US Dollar. Purchasing Power Parity and Interest Rate Parity theories suggest that exchange rates often move in reaction to changes in interest rates. The US raised interest rates sharply last year, making the dollar more attractive relative to currencies in countries that did not raise rates. Over the next year or two, foreign rates are likely to rise, following moves in the US. That will make foreign currencies appreciate, which will add to total market returns for US investors who own stocks that are denominated in foreign currencies.

Bonds may have another below-average return in 2023. The 10 year treasury yield ended 2022 at 3.88%. This was much lower than shorter term bond yields, which is an untenable long term situation. History has shown us that the yield curve does not remain inverted for too long. We expect the 10 year yield to climb, which would cause prices for longer term bonds to drop again in 2023. A slight drift up in yields to 4% or 4.25% would weigh on bond prices and keep total returns for 2023 lower than the 6.9% long term average annual return. We carried a bond duration underweight in our Advyzon Investment Management portfolios in 2022 and we are continuing this positioning for the start of 2023.

The economy may fall into another technical recession in 2023 and make headlines in the press, but it is unlikely to be felt severely by most US citizens and have a meaningful impact on corporate earnings. When measuring Gross Domestic Product (GDP) to determine whether the U.S. is in a recession or not, economists prefer to use the “real” level of GDP, which starts with the actual dollar measurement of GDP in the 2^nd^ column below, and subtracts out inflation, resulting in the 4^th^ column below. So even if GDP grows in actual / “nominal” dollars and revenues for US companies are growing, elevated inflation levels could bring the ignoring-inflation measurement down into negative growth territory, like the two red values in the 5^th^ column below from 2022. It is unfortunate that what sometimes happens, is people read headlines that we are in a recession, which can prompt jumpy consumers to cut back on spending, subsequently contributing toward a worse GDP level next quarter (a self-fulfilling prophecy).

Disclosures

Opinions expressed are as of the current date; such opinions are subject to change without notice. Advyzon Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment or a recommendation for a particular product.

Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. This commentary contains certain forward-looking statements. We may use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

Investment management and financial advice offered by Advyzon Investment Management is intended for citizens or legal residents of the United States or its territories. Investing in securities involves risks, including but are not limited to; currency risk, political risk, geographic risk, concentration risk, custody risk, asset class risk, management risk, market risk, operational risk, passive investment risk, securities lending risk, tracking error risk, tax risk, valuation risk, and infectious illness risk. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. High yield debt (non-investment grade or junk bonds) can be more risky than higher rated debt, typically has a higher default rate than investment grade and treasury debt, and high yield funds can lose principal.

“SBBI” stands for “Stocks, Bonds. Bills, and Inflation”. “Stocks, Bonds, Bills, and Inflation”, “SBBI”, and “Ibbotson” (when used in conjunction with a series or publication name) are registered trademarks of Morningstar, Inc. ©2021 Morningstar.

“CRSP” stands for Center for Research in Security Prices. Part of the University of Chicago’s Booth School of Business, the CRSP is a nonprofit organization that is used by academic, commercial, and government agencies to access information such as price, dividends, and rates of returns on stocks.

The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Advyzon Investment Management cannot guarantee its accuracy, completeness or reliability.

Cryptocurrencies, including Bitcoin, are currently unregulated, illiquid, uninsured, carry technological risks, require unique tax treatment, and are volatile.