Asset Class Recap

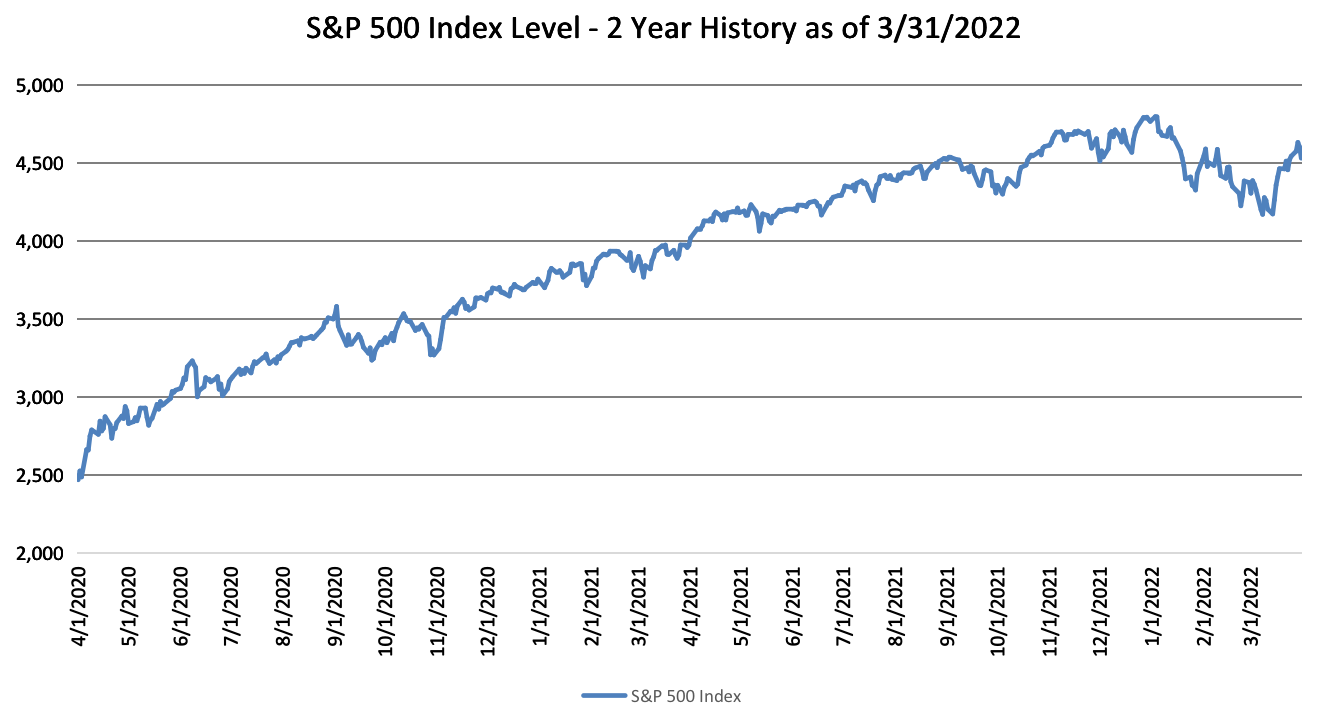

Stock market prices rebounded a bit in March to temper losses from January and February. The chart below shows the level of the S&P 500 index over the last two years. At the far right, you can see the January and February pullback and the partial rebound in March. Rising interest rates, the war in Ukraine, high inflation, and a new flare-up of COVID in China have dominated financial press headlines as leading causes of market concern in 2022.

Source: S&P Dow Jones Indices

Bonds have fared worse than stocks so far in 2022, with the Bloomberg US Aggregate Bond index posting negative returns for the last four consecutive months (Dec 21, Jan 22, Feb 22, and March 22). When prevailing interest rates rise, prices for fixed coupon bonds drop. As the US Federal Reserve has announced that they plan to increase interest rates more quickly than many investors expected to help fight inflation, the price drop for bonds has been unusually swift, outpacing the coupon payments these bonds pay to investors each month or quarter. The upside of higher interest rates for bond investors is higher coupon payments in the future after matured bond principal is reinvested. Investors in CD’s should see the same rising rates and higher yields.

This interest rate to current price relationship (known by bond experts as Duration) impacts longer term bonds more strongly than intermediate and short term bonds. The table below shows that Intermediate / Aggregate Bonds are down 5.9% year-to-date while Long Term Bond prices are down more than 10%. While longer term bonds are generally more attractive than intermediate and shorter term bonds because they pay higher interest rates, their downside is that they can have periods of strong negative performance when rates rise. For that reason, longer term bonds can an appropriate investment to achieve long term goals (over five years away), however, they may disappoint for short term goals and conservative portfolios.

Returns for each of the asset classes we include in our long term core diversified portfolios are listed below.

Source: Morningstar

Often, market events and subsequent price changes impact asset class returns broadly and most sectors move roughly in unison or at least in the same direction. That has not been the case recently, as the table below shows. S&P Dow Jones assigns each of the 500 stocks in the S&P 500 index into one of 11 sectors. They track total return for each of the sectors. The table below displays returns for each of the last 5 years, for Year to Date, and for 1, 10, and 20 years for each sector. The Year to Date returns in the bold column show how Energy stocks have shot up in 2022 as well as 2021, after four consecutive years of underperformance - classic “reversion to the mean”. Portfolios that focus on Environmental, Social, and Governance issues (ESG oriented products) face headwinds to performance in this type of market because they underweight or overtly exclude oil related stocks.

Source: Morningstar. Returns longer than 1 year are annualized.

Market Expectations

Although we always invest with a focus on the long term, we want to understand short and mid term market risks. The market is generally a good voting machine, balancing potential positive factors and potential negative factors to arrive at fair market prices for securities. As news happens, it is absorbed by market participants each day and very quickly factored into updated prices. The graphic below lists some events that are currently weighing on market prices and creating uncertainty, both on the positive and negative sides. Returns for the remainder of 2022 will in part depend on how these events work themselves out.

Disclosures

Opinions expressed are as of the current date; such opinions are subject to change without notice. Advyzon Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment.

Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. This commentary contains certain forward-looking statements. We may use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

Investment management and financial advice offered by Advyzon Investment Management is intended for citizens or legal residents of the United States or its territories. Investing in securities involves risks, including but are not limited to; currency risk, political risk, geographic risk, concentration risk, custody risk, asset class risk, management risk, market risk, operational risk, passive investment risk, securities lending risk, tracking error risk, tax risk, valuation risk, and infectious illness risk. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. High yield debt (non-investment grade or junk bonds) can be more risky than higher rated debt, typically has a higher default rate than investment grade and treasury debt, and high yield funds can lose principal.

“SBBI” stands for “Stocks, Bonds. Bills, and Inflation”. “Stocks, Bonds, Bills, and Inflation”, “SBBI”, and “Ibbotson” (when used in conjunction with a series or publication name) are registered trademarks of Morningstar, Inc. ©2021 Morningstar.

“CRSP” stands for Center for Research in Security Prices. Part of the University of Chicago’s Booth School of Business, the CRSP is a nonprofit organization that is used by academic, commercial, and government agencies to access information such as price, dividends, and rates of returns on stocks.

The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Advyzon Investment Management cannot guarantee its accuracy, completeness or reliability.

Cryptocurrencies, including Bitcoin, are currently unregulated, illiquid, uninsured, carry technological risks, require unique tax treatment, and are volatile.