There have been many news stories recently about recent high inflation readings. During recent client meetings, clients have asked; “Are the recent high inflation readings cause for concern?”, “How could high inflation impact me?”, and “What actions should I take with my investments?” I review these concerns below.

Are recent high inflation numbers reason for concern and what is causing them?

A short bout of inflation should not be a concern for long term investors. I expect this inflationary period to last less than a year, until supply chains return to normal and catch up with pent up demand. Abnormally high or low inflation is typically caused by unexpected political, environmental, or social events. If these events persist for an extended period of time, high inflation could also persist or multiple years. However, if the events promptly subside, inflation and prices should promptly return to normal levels. COVID has affected financial markets and global economies in multiple ways, on both the demand and supply sides, but even if COVID stays “with us” like the flu, demand and supply should return to equilibrium soon.

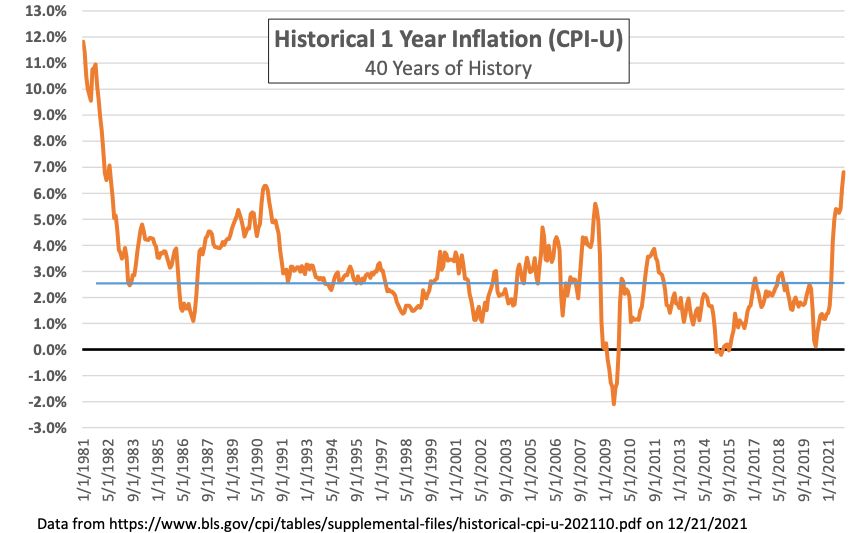

The inflation reading that has been reported in this week’s headlines is a 6.8% increase in CPI-U between 11/30/2020 and 11/30/2021. The average 1 year inflation since 1926 has been 2.9% so this value is more than double the long term average - certainly an eyebrow raising jump. The inflation percent change is calculated using both the beginning price for a large basket of goods, and the ending price for the same basket of goods (any percentage is calculated as end value minus start value divided by start value). Last year, when the impacts of COVID were hitting us hard, demand for many goods was lower than normal. This resulted in inflation that was abnormally low last year because demand was low (see the big dip in 2020 in the chart below). Few newspapers reported the unusually low inflation because we had many more important things to worry about. Although COVID is continuing to impact us in many ways, demand for many products has returned to more normal levels. Because many people weren’t working last year and many products weren’t being produced, we now have shortages for some products that have driven prices up - so we should not be too surprised that our percentage formula is resulting in higher than normal values this year.

Aside from COVID, another important factor pressuring inflation toward the upside is our federal government’s historically strong stimulus and COVID relief programs for families and businesses. While these programs helped millions of people in very important ways, inflationary pressure is one unfortunate consequence. Deficit spending by our federal government has been on the upswing for many consecutive years, adding inflationary pressures that may have more of a long-term impact, as this spending is unlikely to be reversed soon.

On the deflationary side, improving technology continually makes US production more efficient, reducing prices. Household savings in the US has been on the upswing for the last couple decades, which is also deflationary. All of these forces come together to impact prices, but COVID’s impact is clearly in the driver’s seat recently.

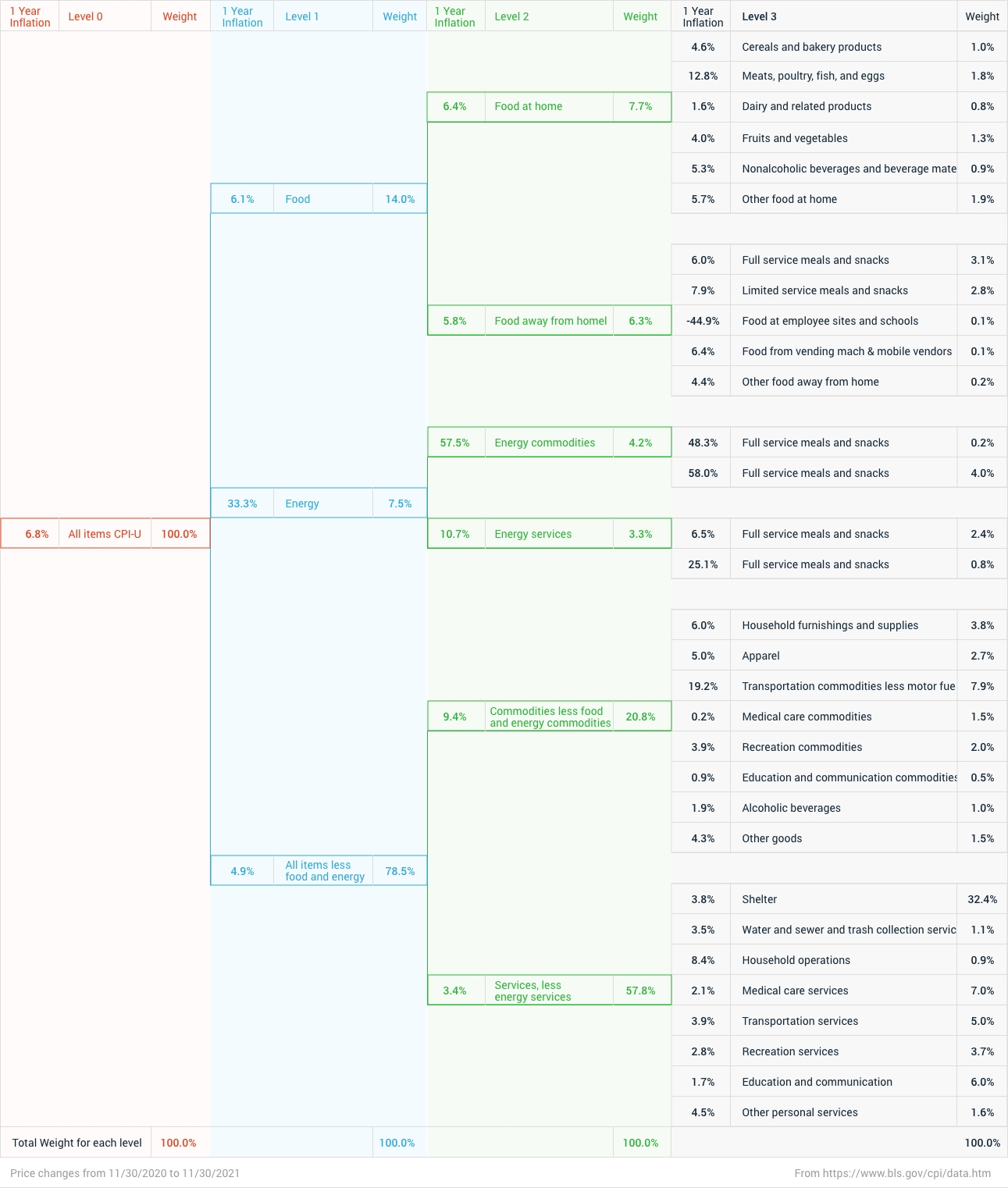

The US Bureau of Labor Statistics (BLS) reports inflation broken out into 8 levels of varying granularity, organized by types of products and services, with the weightings of each constituent adding up to 100%. Levels 0, 1, 2 and 3 are broken out below using different colors and help identify drivers of inflation.

Level 0 is the comprehensive top level value that is reported each month for US inflation (in red below). This is the 6.8% number we see in headlines. The columns to the right show more granular groups.

Level 1 is the first sub-group and has 3 constituents (in blue above). Column D shows the inflation for each category while Column F reports each category’s weighting. It is clear that Energy’s 33% jump is very high, but oil and gas prices often see this type of annual move. Small changes in supply and demand can move energy prices a lot, a result of what economists call “inelastic” demand. Consumers have seen gas prices at the pump bounce up and down between $2 and $5 for years. Prices are high today, but it is a very safe bet that they will come back down as oil production is increased in the next few months or year.

Level 2 is the second sub-grouping with 6 categories (in green above). It doesn’t add much additional information.

Level 3 is the third sub-grouping with 31 categories (in black above) and is much more interesting. Here we can get a better idea about what is really moving prices. Five of these categories had inflation over 10%.

• Fuel oil, Motor Oil, and Utility Gas are clearly higher due to high raw oil and gas prices. As discussed above, this is almost certainly temporary, as we have seen many large price swings in the past.

• Transportation (less fuel costs) is up 19.2%. Vehicle prices are up significantly. There have been many headlines about temporary chip and other car part shortages due to COVID related factory shutdowns that have stymied Detroit from completing and delivering new vehicles. This is certain to be temporary, as workers return to factories and catch up with orders and additional chip manufacturing capacity is added. Unrelated to COVID, and potentially a more long term impact for transportation is the dynamic that electric cars generally cost more than similar fossil fuel powered cars. Consumers are willing to pay more up front for an electric car that gets more than 100 MPGe and costs less to operate over time. This factor may be a bit stickier for inflation readings.

• Meats prices are up 12.8%. News articles have identified causes as; strong demand, COVID related labor shortages, COVID related supply chain disruptions, higher feed costs due to winter storms and drought, and a processing facility closure due to cybersecurity attacks impacted beef and other meat production in May. Each of these sounds temporary to me except for higher demand.

How could high inflation impact my finances?

Inflation hits each part of our finances differently. When doing financial planning, we build an Asset and Liability statement and Budgets that can be helpful to segment inflation’s effects. Finances for a 40 year old, and the inflationary impacts might look like this -

| $48,000 | Annual Expenses (excluding mortgage) | Expenses, or the “cost of living” are the thing that CPI-U is designed to measure. Unless your expenses are highly unusual (e.g. very young or elderly people), your expenses should change roughly in line with inflation. High CPI-U changes indicate an unfortunate increase in your expenses. |

| $100,000 | Salary | Changes in pay have historically tracked well with CPI, meaning that most people can count on their pay increasing to help offset the increase costs of purchasing food and services, however, there is often a timing delay. |

| $100,000 | Stock investments | Stock prices typically rise with inflation, making them good to own during inflationary periods. Most corporations are able to pass on production and employee cost increases to customers through price increases. Stock prices in some sectors move more closely with inflation than others, depending on how quickly they can pass on price changes or renegotiate purchasing contacts with suppliers. |

| $30,000 | Bond investments | Fixed coupon bonds (most bonds have fixed coupon payments) are bad to own during inflationary periods because their prices drop so that yields match prevailing nominal interest rates. |

| $400,000 | Home market value | Real estate values typically rise with inflation, making homes and real estate a good investment during high inflation. |

| $300,000 | Home mortgage or student loans | Home owners with fixed rate mortgages and young workers with student debt benefit during high inflationary periods. Their wages usually rise, but their payments are locked in and stay the same. Home owners with variable rate mortgages are often worse off, as their payments rise with increases in nominal interest rates. |

| $30,000 | Credit card debt | Interest rates for credit cards tend to adjust with inflation, making credit card debt detrimental to have during high inflationary periods. |

| $5,000 | Cash in the bank or under the mattress | Cash holders lose purchasing power that is exactly equal to the inflation rate during inflationary periods. |

| $5,000 | Physical gold or silver | Some people keep physical or investment security holdings in precious metals, specifically because their prices tend to move with inflation. |

What financial actions should I take if I am concerned about inflation?

Some investments tend to be correlated with inflation and some are not - meaning the prices for some investments tend to go up when inflation goes up and they help protect investors from the detrimental effects of inflation. If we believed that inflation was going to be high (over 5%) for the next few years, we would want to overweight inflation fighting investments in our investment portfolios. The unfortunate downside of holding large amounts of inflation hedged investments in a portfolio is that they tend to have lower overall returns in the long run. The long term, diversified multi-asset portfolios that we use for our investments at Advyzon Investment Management include some allocations to inflation protecting securities, but we do not go overboard, as inflation is expected to be temporary.

• All of our portfolios hold stocks, which tend to move with inflation.

• Our fund managers have investments in the Energy, Utilities, and Real Estate sectors, which tend to move with inflation.

• Blackrock Total Return is an active bond fund in our portfolios that holds some exposure in Floating Rate Notes and Inflation-Indexed Bonds.

These investments combine to help give our portfolios some protection against high inflation.

If investors seek additional inflation protection, they can purchase funds or individual securities in the categories mentioned below. I am happy to recommend investments.

*Among Equities

Good for hedging inflation = Energy, Utility, and Real Estate sector stocks

Bad for hedging inflation = Non-US stocks, Consumer Discretionary, and Financials

*Among Bonds

Good for hedging inflation = Floating Rate Notes, TIPS, and Short Term Bonds

Bad for hedging inflation = Long Term Fixed Coupon Bonds

*Among Alternatives

Good for hedging inflation = Commodity related products, Art, and Precious Metals. We have not seen how Cryptocurrencies act during periods of high inflation, but I suspect they will be good inflation hedges.

Bad for hedging inflation = Fixed Annuities and Structured Notes